- The Dow Jones Industrial Average posted its worst day since the October 1987 crash on Thursday, after dropping more than 8% and falling deeper into a bear market.

- “I’d say during the last 48 hours, there has been a switch flipped from trying to measure the uncertainty to panic,” KKM Financial CEO Jeff Kilburg said.

- “Markets can definitely go down further as we are headed for a recession but bear markets are the best time to buy stocks for long-term investors,” Bleakley Advisory Group chief investment officer Peter Boockvar said.

Thursday’s plummet in U.S. stocks left some traders fearful over how much more pain they can withstand.

“I’d say during the last 48 hours, there has been a switch flipped from trying to measure the uncertainty to panic,” KKM Financial CEO Jeff Kilburg said.

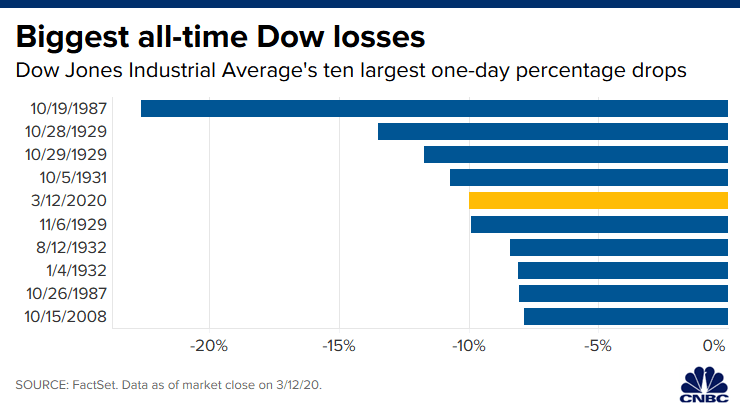

The Dow Jones Industrial Average fell 10%, posting its largest one-day percentage drop since the October 1987 crash. That day, the Dow collapsed by more than 22%.

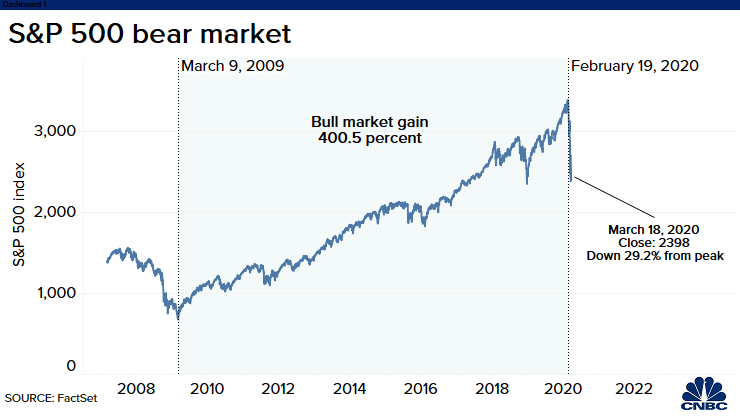

The S&P 500 joined the Dow in closing Thursday’s session squarely in a bear market, down more than 20% from the all-time highs set just a month ago. The indexes also ended an 11-year bull run, the longest on record. It took the Dow just 19 trading days to fall from a record high into a bear market. The S&P 500′s move was even swifter, taking the broad index just 16 trading days to tumble into a bear market.

Peter Boockvar, chief investment officer at Bleakley Advisory Group, said the economic damage is “deep and profound” and that “until we get to spring time when hopefully this goes away, we as investors are all flying blind.”

The Federal Reserve announced extraordinary funding actions of more than $1 trillion to ease strained capital markets in the wake of the coronavirus sell-off. The news gave stocks a brief boost before they headed lower again.

It “certainly helps,” Miller Tabak’s Matt Maley said of the stimulus, but added that “the market is still looking for a lot more on the fiscal side.”

The volatility in the market has been relentless. The Cboe Volatility Index (VIX), widely considered the best fear gauge in the market, shot up to it its highest level since 2008 on Thursday, trading above 72.

The sharp move come as investors weigh the potential economic slowdown from the coronavirus along with the lack of a robust fiscal response from the U.S. government.

President Donald Trump said Wednesday night the administration would provide financial relief for workers who are ill, caring for others due to the virus or who are quarantined. These moves were not enough for investors, however, who were looking for a more targeted fiscal response to address the issue slower economic growth stemming from the coronavirus.

Buying opportunities

Despite the sell-off, which has spooked investors and led to steeper losses, both Kilburg and Bookvar think this downturn can be an attractive buying opportunity for those with longer-term time frames.

“In this chaos, opportunity presents itself,” Kilburg said. When there’s a spike in the CBOE Volatility Index, or VIX, commonly referred to as Wall Street’s fear gauge, it’s time to buy stocks. It’s currently trading around 69 and Kilburg said he’s re-balancing portfolios and looking for attractive buying opportunities.

Boockvar said that while the selling isn’t over since “we are headed for a recession,” there’s also opportunity since “bear markets are the best time to buy stocks for long term investors.”

“We would rather buy stocks when markets are down sharply than chasing them higher as they get more expensive,” he added.

Maley of Miller Tabak said he sees lots of signs of market capitulation and believes there will will a strong bounce in the near term, which should give investors an opportunity on load up on “high quality names with good balance sheets and lots of cash.”

Rather than trying to call a bottom in stocks that have been hit especially hard, such as airlines and casinos, Maley instead advised choosing names with strong underlying fundamentals.

“Investors should avoid trying to hit a grand slam homer with the risky names, when they can hit a 2-run home run (or even a 3-run home run) in some of those high quality names while taking a lot less risk,” he said.

After a period of unprecedented economic expansion that began in 2009 following the financial crisis, the market drop is unnerving even to those who said the bull was on its final legs.

“I would say just breathe. I’ve lived through a couple different crises; the bubble, the crisis. All these events are very different but they are similar in nature,” Kilburg advised. “Typically when that panic sets in, that is the spike.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

Source: CNBC