Key Points

- Risk is often the result of a very high degree of confidence among market participants in one particular outcome.

- The top ten global risks for investors in 2020 are all surprises to the consensus view: return of inflation, trade tensions don’t fade, manufacturing recovery fails, Brexit ends badly, rising costs prevent earnings rebound, job cuts, geopolitical conflict, surprise election outcome, increased regulation, and ineffective monetary policy.

- Having a well-balanced, diversified portfolio and being prepared with a plan in the event of an unexpected outcome are key to successful investing.

We typically start off the new year with a look at the biggest potential downside risks for investors in the year ahead. Last year, the markets seem to have been focusing on the upside surprises with all major asset classes producing above average returns in 2019, even as the global economy slowed and earnings growth stalled. So, while none of these make our base case for 2020, a review of the top investment risks in greater depth may be useful as we enter the New Year.

Top ten risks for 2020

History shows us that the biggest risks in any year aren’t usually from out of left field (although that sometimes happens). Rather, they are often hiding in plain sight. As goes one of my favorite quotes: “It ain’t what you don’t know that gets you in trouble, it’s what you know for sure that just ain’t so.” Risk appears when there is a very high degree of confidence among market participants in a particular outcome that doesn’t pan out. So, by identifying the unexpected, here are the top ten global downside risks for investors in 2020, in no particular order:

- Return of Inflation

- Trade tensions don’t fade

- Brexit ends badly

- Rising costs prevent earnings rebound

- Manufacturing recovery fails

- Geopolitical conflict

- Surprise election outcome

- Job Cuts

- Increased regulation

- Ineffective monetary policy

Let’s take a brief look at each of these 2020 risks.

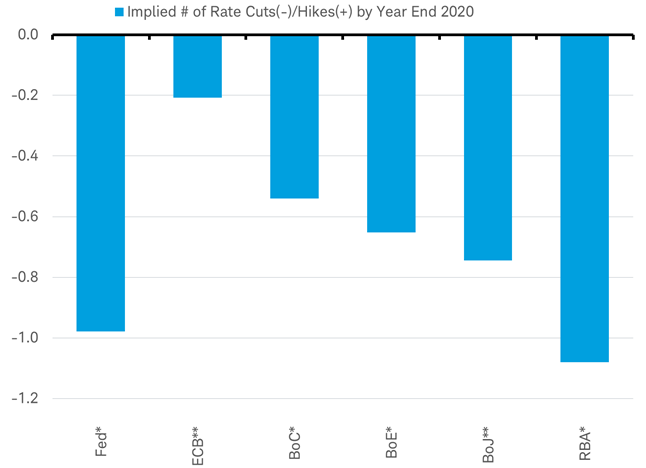

1. Return of inflation. Central bank policy is a persistent risk to the market. Yet for 2020, few expect any material uptick in inflation that would prompt central banks to raise interest rates. The current economist and market consensus is that inflation will remain muted, much the same as in 2019. To use the U.S. as an example, only a quarter of the 70 economists tracked by Bloomberg expect U.S. inflation to rise by half of a percentage point or more in 2020. Historically, inflation usually moves by more than a percentage point in any given year and has moved by at least a half a percentage point in 15 of the past 20 years. The risk is that inflation surprises to the upside and forces central bankers to raise interest rates more than expected. This outcome has ended many past economic and market cycles.

Central banks seen as more likely to cut, not hike, rates in 2020

*typical 25 basis point move

**typical 10 basis point move

Fed=US Federal Reserve, ECB=European Central Bank, BoC=Bank of Canada, BoE=Bank of England, BoJ=Bank of Japan, RBA=Reserve Bank of Australia

Source: Charles Schwab, Bloomberg data as of 1/3/2020.

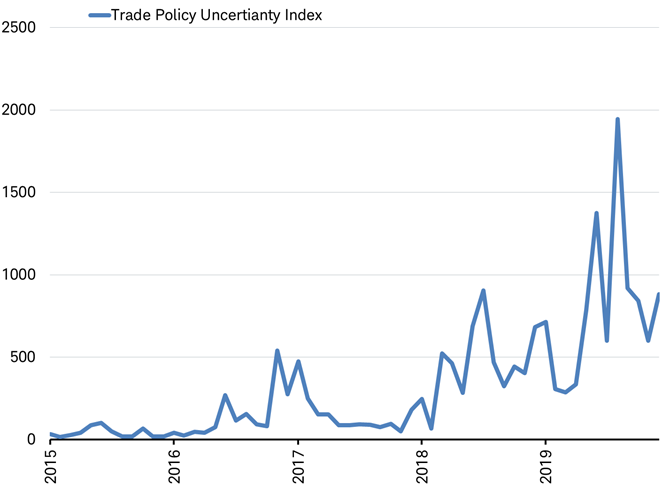

2. Trade tensions don’t fade. Markets have responded positively to the “Phase One” deal between the U.S. and China, seeming to believe 2019 was the peak in trade tensions and that 2020 will see them fade. However, while the “Phase One” trade deal stops the escalation of tariffs (at least temporarily), it does nothing to restrict use of other legal and political tools to try to constrain technological advances. As the U.S.-China strategic conflict becomes more focused on technological leadership, it may impact stocks in the technology sector which led the global stock market higher in 2019.

While the U.S.-China trade conflict has garnered much of the world’s attention, the largest trading relationship in the world is between the U.S. and European Union. Trade tensions between these two parties could heat up following WTO-approved tariffs in response to illegal support for airplane makers and France’s new digital services tax on U.S. tech companies.

Has trade uncertainty peaked?

Source: Charles Schwab, Bloomberg data as of 1/3/2020.

3. Brexit ends badly. Both the British pound and U.K. stocks rallied in response to Prime Minister Johnson’s Brexit deal being passed by Parliament. This deal helps sets the stage for the U.K. to leave the European Union (EU) on January 31, 2020. However, this isn’t the end of Brexit. During the transition period that runs until the end of 2020, the U.K. and the EU will need to negotiate a new trading agreement. As the year goes on, there should be indications as to the success of these negotiations. If evidence points to no agreement, the year-end split with the EU could have similar economic impacts to a no deal Brexit. The markets may begin to price in the risk of disruptive economic consequences.

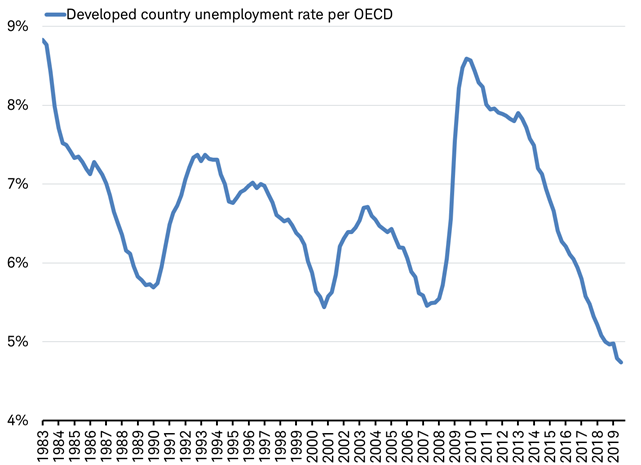

4. Rising costs prevent earnings rebound. Despite a weak revenue picture, analysts expect a 9-10% rebound in earnings per share in 2020 for the global companies in the MSCI World Index, which saw no growth in 2019. This expectation could be threatened by a rise in costs. Labor is the biggest cost for most companies and record low unemployment rates combined with weak productivity could mean pressure on wages to rise, squeezing corporate profit margins and resulting in weaker than anticipated earnings. After a rise in valuations lifted stocks around the world in 2019, an earnings recovery may be needed to cement or build on last year’s gains.

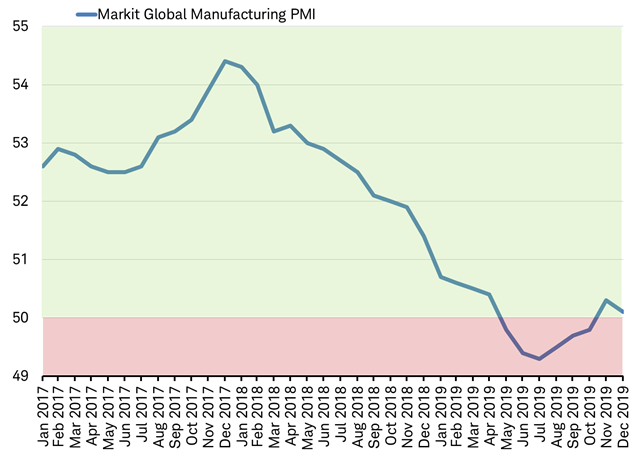

5. Manufacturing recovery fail. After a 15-month long global manufacturing downturn, a four-month rebound began in August 2019. However, December registered a decline to 50.1, a hair’s breadth above the dividing line between expansion and contraction of 50.0, as you can see in the chart below. The leading component of the index, new orders also weakened, suggesting manufacturing might be running out of steam just as it was about to start growing again.

Manufacturing rebound stalling?

50 marks dividing line between expansion and contraction in the global manufacturing sector.

Source: Charles Schwab, Bloomberg data as of 1/3/2020.

6. Geopolitical conflict. The markets have been largely immune to geopolitical incidents of the past two years. It showed little response to terrorist attacks in the Strait of Hormuz, Turkey’s invasion of Syria after the U.S. withdrawal of support for the Kurds, Iran shooting down a U.S. surveillance drone, the attack of Saudi oil processing facilities which temporarily cut Saudi oil production in half, the protests in Hong Kong ignited by a controversial extradition bill, or the murder of Jamal Khashoggi, a Saudi dissident and journalist with the Washington Post. A number of geopolitical concerns for 2020, including those with North Korea and Iran, may interrupt the market’s calm.

7. Surprise election outcome. The biggest global political event in 2020 is the U.S. election. For now, markets seem to be unresponsive to the candidates’ rise and fall in the polls. But, as the election draws closer, the markets may start to price in the potential for sweeping changes with uncertain impacts for legislation-sensitive sectors like financials, health care, and energy.

8. Job cuts. In 2019, as unemployment rates fell to multi-decade lows, most employers seemed focused on finding more workers—rather than laying them off. Although trade deals are being completed, they have not yet stimulated demand growth or global trade. Unsold inventories are piling up. After cutting spending on equipment in 2019, business leaders might begin to cut jobs if demand doesn’t improve. Signs of weakness in the global labor market may undermine consumers’ high confidence leading to a pullback in spending and a possible recession.

World unemployment rate ended 2019 at multi-decade lows

Source: Charles Schwab, Bloomberg data as of 1/5/2020.

9. Increased regulation. Regardless of the U.S. election outcome, a movement toward increased regulation has taken hold among legislators in countries around the world, focusing on a range of issues from data privacy to climate change. Increased operating costs, litigation, lobbying and other expenses could result in lower expected earnings.

10. Ineffective monetary policy. Market participants exhibited a high degree of confidence in central bankers’ powers to manage the global economy in 2019. Yet, monetary policy may be nearing the end of its usefulness in stimulating global economic growth.

Upside surprises

Of course, it’s not all negative. There may be upside surprises in 2020 as well, such as: meaningful fiscal stimulus by world governments, a rebound in business spending, and a reacceleration in China’s economy. With the latest reading for the OECD’s global composite leading indicator ticking up for the first time in two years, perhaps global growth may pickup in 2020, rather than merely stabilize.

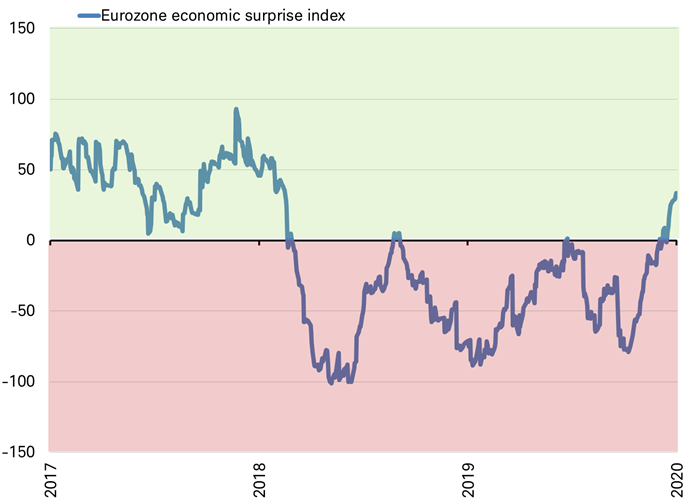

As we consider unexpected positive impacts, it’s worth noting that European economic data has been surprising on the upside in recent weeks, after disappointing economists in both 2018 and 2019.

Eurozone economic data upside surprises return

Zero marks the threshold between economic data surprising on the upside or downside relative to the Bloomberg-tracked economists’ median forecast.

Source: Charles Schwab, Bloomberg data as of 1/5/2020.

Be prepared

Whether or not these particular surprises come to pass, a new year almost always brings surprises of one form or another. Having a well-balanced, diversified portfolio and being prepared with a plan in the event of an unexpected outcome are key to successful investing.

What You Can Do Next

- Follow Jeffrey Kleintop on Twitter: @JeffreyKleintop.

- Explore other topics on Insights & Ideas.

- Talk to us about the services that are right for you. Call us at 800-355-2162, visit a branch, find a consultant or open an account online.

Source: charles SHWAB